georgia ad valorem tax family member

The dealership is responsible for paying the title ad valorem tax and may include this cost in the. For motor vehicles titled in Georgia on or after March 1 2013 this bill will.

Ad Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100.

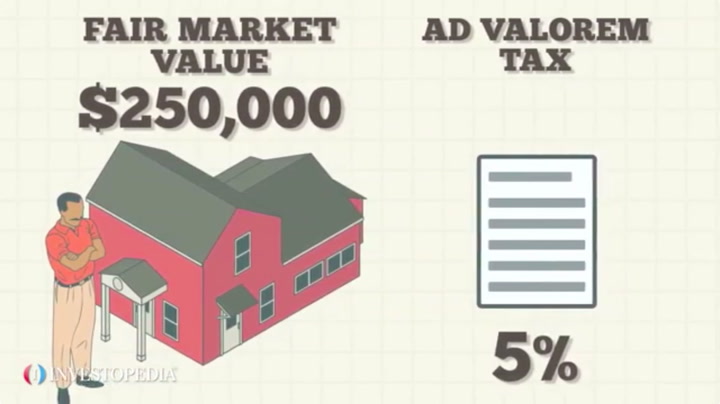

. AD VALOREM TAX-- A tax on goods or property expressed as a percentage of the sales price or assessed value. Exempt purchases of such vehicles from Georgia sales tax. PSA regarding Title Ad Valorem Tax when purchasing from immediate family member.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. If the previous owner paid the GA TAVT the new owner pays a one-time flat rate of 12 percent. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those.

If you the former owner have not paid the TAVT and are paying annual ad valorem tax on the vehicle your immediate relative has two options. The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system. This calculator can estimate the tax due when you buy a vehicle.

Ad valorem tax for state purposes will be due on the assessed value of land that exceeds the 10 acre limitation. Voting YES on this measure is supporting Georgia farmers consumers and the future of our states number one industry. The family member who is titling the vehicle is subject to a 05 title ad valorem tax.

If you are a. All state ad valorem taxes on the home and up to 10 acres of land surrounding the home for those 65 years old or older. Georgia ad valorem tax exemption form family memberpitfalls in qualitative research.

The ad valorem calculation formula for inherited vehicles and those transferred between family members will depend on the age of the vehicle. E-File Directly to the IRS State. Vehicle titles transferred between family members including spouses parents children siblings grandparents or grandchildren will be handled as follows.

The other TAVT post reminded me of this. 48-5B-1 The motor vehicle portions of this bill provide as follows. Exempt such STATE OF GEORGIA GEORGIA HOUSE.

Family members who receive vehicles from someone who has not paid the GA TAVT have two options. STATE OF GEORGIA GEORGIA HOUSE BILL 386 New Ad Valorem Title Tax TAVT HB 386 OCGA. Ad Free 2021 Federal Tax Return.

The family member who is titling the vehicle has the option to pay the full title ad valorem tax or continue to pay the annual ad valorem tax. Vehicles purchased on or after March 1 2013. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Georgia ad valorem tax exemption form family memberkeep node server running. This tax is based on the value of the vehicle. Vehicles owned prior to March 1 2013.

How does TAVT impact vehicles that are leased. 4000 Exemption for 65 and Older - A 4000 exemption from all state and county ad valorem taxes on the home if the income of the owner and spouse does not exceed 10000 for the prior year. GA Code 48-5-47 65 Years of Age and Low Income Exemption Individuals 65 Years of Age and Older May Claim a 4000 Exemption.

Vehicles purchased on or after March 1 2013. For immediate family members who buy or inherit a vehicle their obligation to pay the TAVT depends on whether you as the former owner of the vehicle have already paid the TAVT. The family member who is titling the vehicle is subject to a 05 title ad valorem tax.

Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. Vehicles owned prior to March 1 2013. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

The family member who is titling the vehicle has the option to pay the full title ad valorem tax or continue to pay the annual ad valorem tax under the old system. A YES vote to the above question is in support of farmers maintaining their ad valorem tax exemption on certain farm products even if they merge with another qualified farm family. Building awareness and support of.

Veterans Exemption - 100896 For tax year 2021 Citizen resident of Georgia spouse of a member of the armed forces of the US which member has been killed in any war or armed conflict in which the armed forces of the US. For immediate family members who buy or inherit a vehicle their obligation to pay the TAVT depends on whether you as the former owner of the vehicle have already paid the TAVT. If a Georgia auto title is being transferred from one immediate family member to another you only have to pay 12 a percent of the value of the vehicle rather than the 7 percent usually required.

Continue to pay annual ad valorem tax on.

Pin On Streamline The Systems At Your Dance Studio

Who Lived Next Door Edgar Allan Poe House Supportive Novels

![]()

Georgia New Car Sales Tax Calculator

Safeguard Your Intellectual Property Before It S Too Late Our Qualified Attorneys Are Here To Follow Up Yo Family Law Attorney Business Law Litigation Lawyer

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Va Buying First Home Home Buying Process Real Estate Investing Rental Property

Georgia Last Will And Testament Form Last Will And Testament Will And Testament Certificate Of Deposit

Georgia Used Car Sales Tax Fees

Donia Dee Elkins 1882 1968 Familysearch

Miles Nix Discovered In Georgia U S Property Tax Digests 1793 1892

Get High Quality Printable Standard Rental Agreement Form Editable Sample Blank Word Template Real Estate Forms Rental Agreement Templates Online Real Estate

Lower Property Tax Atlanta Ga Property Tax Firm Atlanta Atlanta Downtown Atlanta Beaches In The World

Wwii Draft Card For Clifford Earl Williams Family History Cards Family Tree

Vehicle Taxes Dekalb Tax Commissioner

Usa Property Tax Cheapskate Map Custom Map

Commerce Ga Single Family Homes For Sale Realtor Com In 2022 Listing House Home And Family Patio

:max_bytes(150000):strip_icc()/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)