update on mn unemployment tax refund

People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. In the latest batch of refunds announced in November however the average was 1189.

State Of Minnesota Passes 2021 Tax Bill Bgm Cpas

As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month.

. Update Unemployment Exclusion The Internal Revenue Service has announced that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. PAUL WCCO Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the next few weeks the Minnesota Department of Revenue said Thursday after the legislature signed off on a tax relief package before ending their work. Minnesota tax law now.

Minnesota Department of Revenue Individual Income Tax 600 North Robert Street. 24 and runs through April 18. Check Your Tax Refund Online Get the latest information on where your property tax or income tax refund is in the process or when we sent it to you.

The Minnesota tax laws enacted on July 1 2021 did not conform to the ERC. Minnesota Department of Revenue Mail Station 0020 600 N. We have updated Minnesota tax forms and instructions for these years.

The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. Paul MN 55145-0020 Mail your tax questions to.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000. We have a process in place and we are following that process. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income.

State officials say refund checks should start going out this week to roughly half-a-million Minnesota taxpayers who filed returns before the legislature passed a law affecting COVID unemployment insurance benefits and businesses Paycheck Protection Program payments making them exempt from Minnesota income tax. Taxpayers who think they qualified but did not receive a refund or a letter explaining changes to their returns can contact us at 651-296-3781. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

The number of returns processed per week will increase as system testing advances and more returns are able to be processed through the system with a goal of processing 50000 returns per week by. They have about 540000 refunds to issue and expect to do 1000 per week so it may take a while. The Department of Revenue issues more than 29 million income and property tax refunds every year Doty said.

Mail your property tax refund return to. Each spouse is entitled to exclude up to 10200 of benefits from federal tax. Minnesota Department of Revenue Mail Station 5510 600 N.

But that doesnt mean the couple as a tax unit always gets tax waived on double the amount 20400. - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13. September 15 2021 by Sara Beavers.

Do I report Paycheck Protection Program loan forgiveness and related business expenses that were not deductible for federal purposes on my Minnesota return. The federal tax code counts jobless benefits. Minnesota Unemployment Refund Update.

The website also states that they sent letters to taxpayers that need to amend their state return. Learn more about electronic filing. The IRS has sent 87 million unemployment compensation refunds so far.

Electronically filing your return and choosing direct deposit for your refund is the most secure and convenient way to file your taxes and get your refund. The number of returns processed per week will increase as system testing advances with a goal of processing 50000 returns per week by late October. Tax season started Jan.

Refunds for about 550000 filers who paid state taxes on the extra 300 and 600 unemployment payments issued during the pandemic likely wont go out until September a Department. Taxpayers must still report a nonconformity adjustment relating to this provision on their nonconformity schedule. These tax law changes were enacted July 1 2021 along with other retroactive provisions affecting tax years 2017 to 2020.

We know these refunds are important to those taxpayers who have. The Minnesota Department of Revenue. Thats the same data the IRS released on November 1 when it announced that.

Paul MN 55146-5510 Street address for deliveries. The Minnesota Department of Revenue has started processing Unemployment Insurance and Payback Protection Program PPP refunds. On Thursday September 9 th the Minnesota Department of Revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of September 13 th.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

Of 62 6 Mn Income Tax Returns Filed For Fy21 45 Mn Processed Says Cbdt Business Standard News

Overview Of Minnesota Unemployment Tax Rates For 2022

Minnesota Business Taxes Spike After Legislature Misses Deadline Minneapolis St Paul Business Journal

House Dfl Proposes Fifth Tier Income Tax For High Earners Some Relief For Ppp Loans And Jobless Benefits Wcco Cbs Minnesota

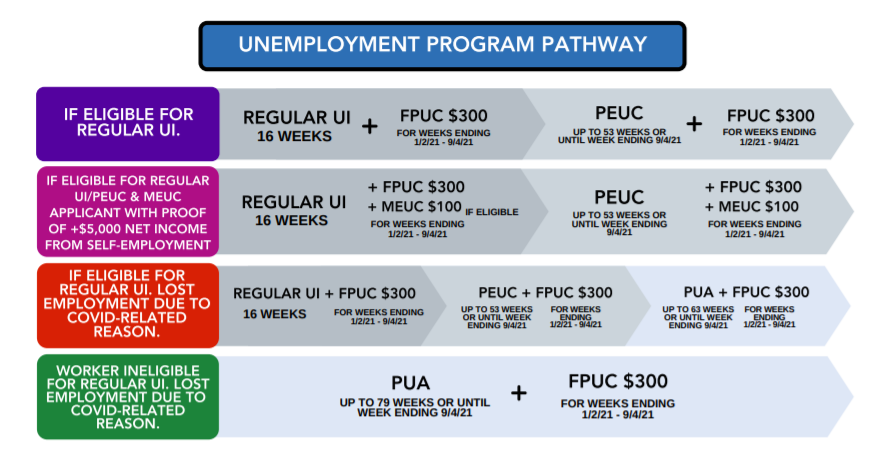

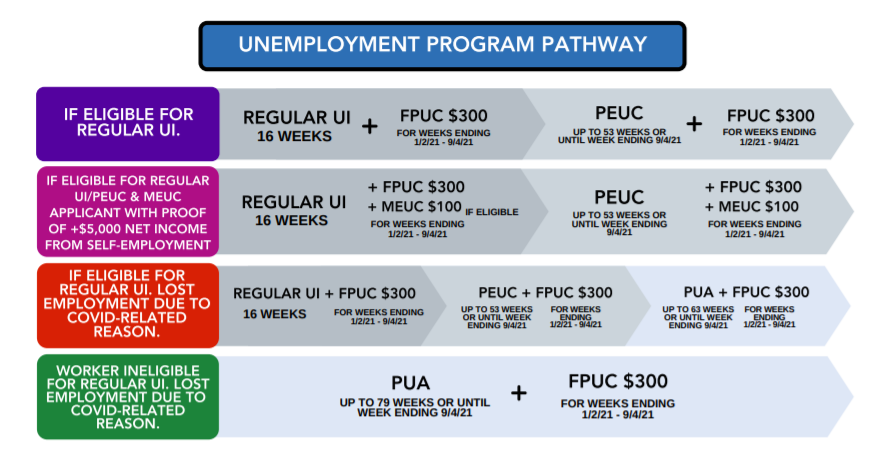

Minnesota Unemployment Relief For Covid 19

Mn Dept Of Revenue Begins Processing Unemployment Insurance Compensation Ppp Loan Forgiveness Wcco Cbs Minnesota

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

Mn Sales Taxes If You Re A Business That Sells Taxable Products Or Services In Mn Whether You File Monthly Or Quart Meant To Be Instagram Posts Sales Tax

Questions About The Unemployment Tax Refund R Irs

Ppp Ui Tax Refunds Start In Minnesota

Minnesota Tax Forms 2021 Printable State Mn Form M1 And Mn Form M1 Instructions

When Will Irs Send Unemployment Tax Refunds Kare11 Com

Minnesota State Tax Refund Mn State Tax Brackets Taxact Blog

Where S My Refund Minnesota H R Block

Minnesota Lawmakers Fail To Prevent Business Tax Hike Squabble Over Worker Bonuses

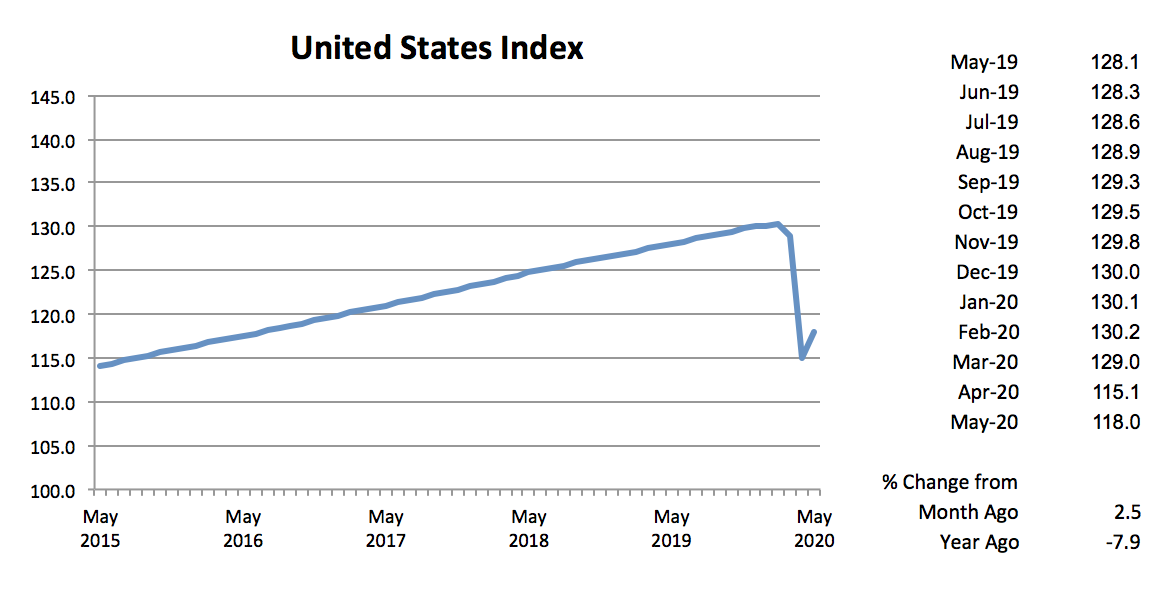

Minnesota Economic Indicators Minnesota Department Of Employment And Economic Development

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota